For the whole of the year 2018 the Cryptocurrency market was in a slump, with prices taking a beating throughout the year. Many started becoming fearful, selling their Bitcoin and other Cryptocurrencies to recoup some money. News started spreading of layoffs from Huobi Exchange, Bitmain, Consensys and other companies in the industry. Skeptics used this opportunity to declare the death of Bitcoin. It all seemed like a lost cause with the only direction being downwards.

Until 1st April 2019.

Depending on your time zone, it was on this day that the price of Bitcoin rose from approximately $4,000 to $4,700, a 17.5% jump in a few hours time. A few days later, the Bitcoin price surged past the $5,000 mark and never looked back (as of May 2019).

We are now in May 2019, experiencing another incredible price rise, with the price of Bitcoin reaching a high of $8,100 (as of 14th May)

With Fidelity entering the picture, Whole Foods accepting Bitcoin as payment, and the upcoming implementation of the Lightning Network, there are many fundamental developments of Bitcoin we can look forward to.

Will This Bitcoin Bull Run Last?

Has it been too bullish too soon or a matter of positive developments in the space finally showing in the price of Bitcoin? Let us hear from experts giving both sides of the argument.

Bullish Argument

Tom Lee, Co-founder of Fundstrat, a research boutique firm that provides financial services to institutional investor, wealth advisors and pension funds is bullish on the near term prospects of Bitcoin.

In a recent interview with CNBC, he claimed that there are 3 catalysts for the rally of Cryptocurrencies, namely more recorded transactions, healthy technical indicators and an increase in trading volumes.

Bearish Argument

“Everything going on here just doesn’t feel right. I don’t see new buyers coming in. Whatever is driving this makes me nervous…. I think this is about to correct and correct hard”- Tone Vays

Tone Vays, a long time derivatives trader and content creator in the space has shared in his short interview with BlockTV that he expects a strong correction in the price of Bitcoin. While he acknowledges a few factors affecting the price such as the possible sell-off of USDT, his stance has been mostly of irrationality in the market.

Regardless of what both sides believe in the short term, it is a fair statement to say that they both believe in the long term future of Bitcoin.

With future developments of Bitcoin to be expected and the consistently rising price of Bitcoin as shown by the chart above, now might be a good time for you to invest in Bitcoin.

So how can you buy Bitcoin in 2019? This guide provides you with all the main options for you to consider.

Buy BTC From ABCC Exchange

Following our partnership with Simplex, all you need is a credit card to buy Bitcoin on ABCC Exchange. Sounds like self-promotion? Read the advantages below and decide for yourself:

- Low minimum purchase amount: While admittedly there are other options that have a lower minimum buy-in, $50 USD is still relatively low

- Fast transaction speed: Many options require a lengthy KYC process tha may take months. Buying Bitcoin on ABCC Exchange takes at most 20 minutes of your time (If you withdraw less than 2 BTC)

- Widely available: As long as you have a Visa or Mastercard, you can make the purchase!

General Steps

Step 1: Confirm your purchase amount

Step 2: Enter your credit card information

Step 3: Do a simple cardholder verification process

Step 4: Have BTC credited to your account

You may find a detailed step-by-step guide for how to buy Bitcoin using a credit card here.

Bitcoin ATM

Depending on the country you currently reside in, Bitcoin ATMs may be an option for you to buy Bitcoin. You can find a Bitcoin ATM near you by doing a search on the Bitcoin ATM Map. While there are variations to the steps needed to buy using the Bitcoin ATM, the general steps are as follows:

- Verification Step (Phone number, IC/Passport details)

- Provide the Bitcoin address for the deposit (alternatively, you can generate a new Bitcoin address there)

- Insert fiat money into the ATM

- Confirm the operation on the ATM

While buying Bitcoin from Bitcoin ATMs is a convenient way to purchase Bitcoin, there are a few notable drawbacks you should take note of.

Firstly, confirmation of transaction typically requires 20 minutes, with some confirmations taking as long as an hour or more before you see the Bitcoin in your wallet depending on the level of network congestion. During the bull run of 2017, users have experienced a few days wait in extreme cases. For new users, this may be an unnerving prospect.

Secondly, transaction fees are relatively higher as compared to other purchase options. Depending on your country, a typical Bitcoin ATM charges 8% transaction fees, with the lowest transaction fee around 4%, which is still relatively higher.

Bitcoin Mining

While Bitcoin mining is not exactly a method to “buy” Bitcoin, it is a viable alternative to obtaining Bitcoin outside of trading for it. Simply put, Bitcoin Mining involves miners including new transactions sent on the Bitcoin network to the new block and being rewarded for it with Bitcoin.

So how can you earn more from Bitcoin mining?

Ever seen rooms or even buildings that house ASICs (Application Specific Integrated Circuits) that run 24/7, 365 days in a year? These machines provide the highest computing power, the key factor in mining more Bitcoin. You can find an image of such a machine below.

If you are a retail investor, especially someone new to the Crypto space, Bitcoin mining is most likely an option that makes little economic sense for you. This is because there are various high costs associated with Bitcoin mining, with the purchase of mining equipment and electricity costs alone accumulating to a hefty sum.

While there are mining pools where a group of retail investors pools their resources together to earn more profits, the rewards earned by the individual may still prove to be unprofitable.

Bitcoin OTC Transaction

Bitcoin OTC (Over The Counter) transaction is another method of buying Bitcoin and a popular one for individuals who wish to invest a large sum of money. This method of transaction involves a peer to peer transaction between a buyer and seller of Bitcoin.

One of the main reasons why some users prefer this method is due to the large amounts of Bitcoin involved in each of the transaction. Had they traded on the secondary market the price of Bitcoin would have experienced wild fluctuations from their trade, especially since market capitalization of Bitcoin is still relatively low.

If you are a normal retail investor wanting to buy less than $1,000 worth of Bitcoin, the OTC transaction is not suitable for you.

In Summary

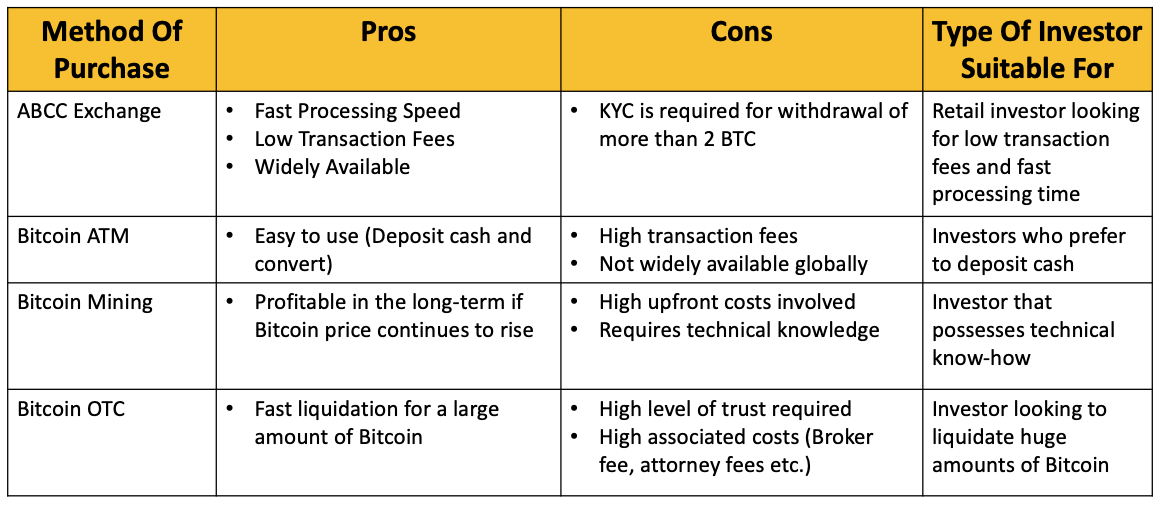

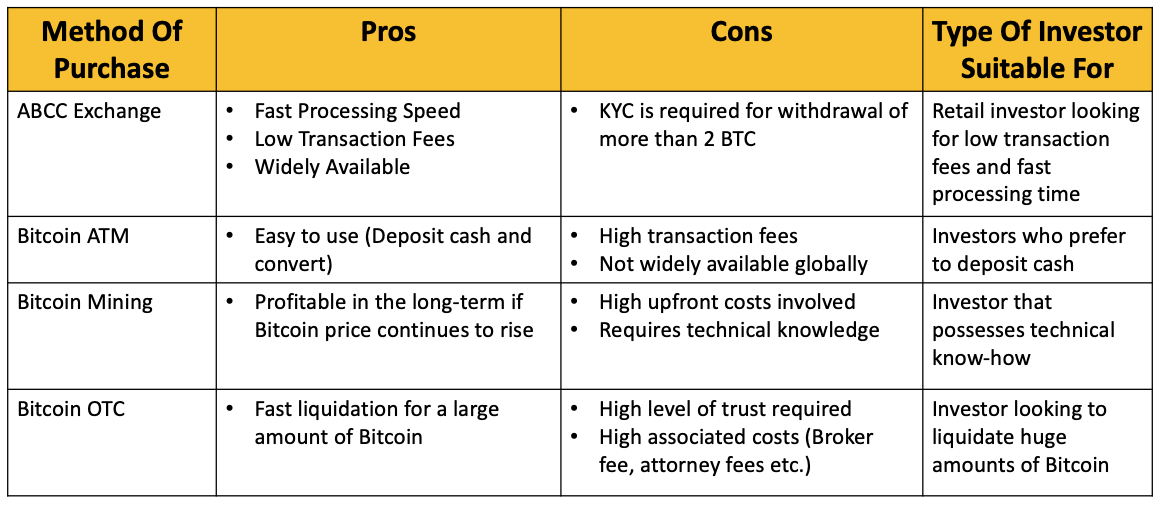

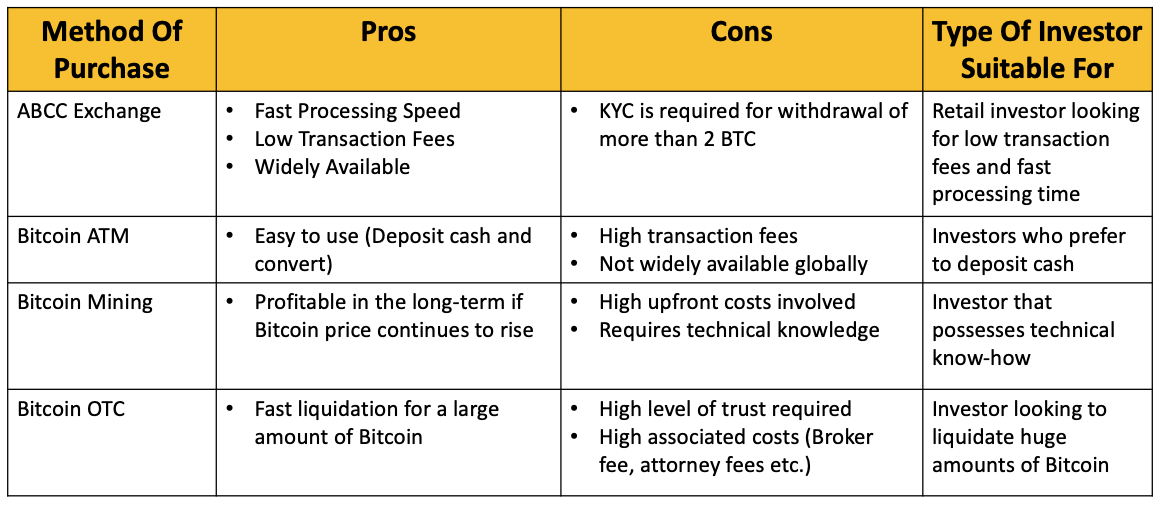

Buying Bitcoin need not be a tedious process for you. While the methods of purchase shared with you are by no means the only methods in the market, they are the main methods that come to mind for most investors.

The table below serves as a quick reference guide for you when comparing the different methods of buying Bitcoin.

Disclaimer: The following content is the view of one writer and is not representative of the views of ABCC Exchange. The content in this article is in no way an endorsement of any project or financial advice of any form. Users are reminded to carry out their own due diligence and execute trades based on their research and risk tolerance.

Follow Us For More Opinion Articles

Website: https://abcc.com

Twitter: https://twitter.com/ABCC_Exchange

Telegram: https://t.me/abcc_en

Facebook: https://www.facebook.com/ABCC-Exchange-558472047871367/

Reddit: https://www.reddit.com/r/ABCC/

Email: contact@abcc-inc.com